On the 26th of March 2012 the President of the Republic of Kenya, Mwai Kibaki announced that Kenya had struck oil after drilling by Anglo Irish company, Tullow Oil. This announcement was at first met by jubilation by Kenyans who were proudly astounded by the prospect of their country joining the league of oil producing countries with all the benefits that may come thereof.

However, after the initial joy of the announcement, what followed were mixed feelings of apprehension, pessimism, jaded optimism and most of all uncertainty. Many Kenyans and foreigners have wondered aloud whether Kenya would succumb to the resource curse that has afflicted many developing countries who discovered huge quantities of minerals or natural resources. Instead of the oil discovery, at the Ngamia 1 oil block in Turkana County in north western Kenya, energizing people to plan for better prospects under oil revenues streams, it has brought improbability. With many interested parties positioning themselves for a share of the cake, the size of which is still unknown.

Should people be uncertain about the oil deposits, I think they shouldn’t. Kenyans should educate themselves about what oil riches mean and how to manage them. They should learn from countries that have managed their natural resources well such as Botswana’s management of its mineral reserves, and Norway’s and Chile’s management of their oil reserves. It is also important that Kenya learns from the negatives of countries that have not managed their resources so well.

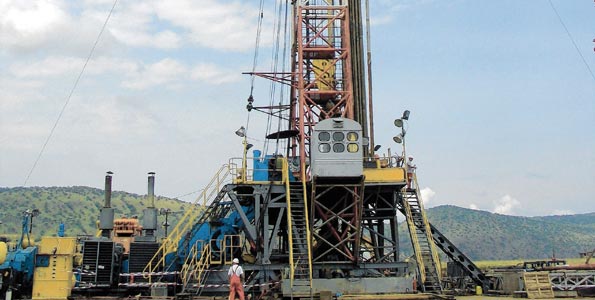

Tullow Oil discovered oil deposits at its first attempt, is this a sinister occurrence? No it’s not, because oil drilling has been happening in Kenya since the 1960s with a BP/Shell joint venture first drilling in 1960. Also 32 wells had been spudded before the Ngamia 1 well struck oil. Therefore there has been a wealth of experience and knowledge accrued through successive drilling campaigns, geophysical and geological studies. To spud a well costs tens of millions of US Dollars. Money which the Kenyan government cannot allocate for drilling, as it has other more pressing social and developmental issues at hand.

The above scenarios point to high risk ventures that may never bare fruit. Many oil companies have come and gone in their exploration pursuits. Woodside an associate company of Shell spent over USD 120 million in the mid-2000s and abandoned its quest without success. CNOOC the Chinese conglomerate also spent around USD50 million and also left without success. The oil block now renamed Ngamia 1 was drilled by Shell and abandoned in the mid-1990s, before the Kenyan government retendered it 2007.

We therefore see this journey has been a long and arduous one that has bore fruit mainly due to better and newer technologies such as oil field simulations that simulates what’s under the ground from data collected via sonic mapping and other geological studies. All over the world improved drilling and oil exploration technologies are yielding hard to find oil discoveries especially to those companies that have the money and capabilities.

Whether the company allegedly associated with prominent Kenyans that allegedly bought and sold Ngamia 1 oil block to Africa Oil Corp (equal partner of Tullow in Ngamia 1) for around USD 10million did it fair and square, I do not know. But what I do know is that it didn’t have the resources and expertise to drill and so sold it to a company with the know how and the risk appetite to take it on.

What Kenyans should be looking at is pushing their legislators to implement stronger laws and regulations that ensure the government of Kenya and by extension its citizens get a fair deal from the oil resources and in the long run oil revenues do not end up enriching a few elite while majority continue to wallow in their daily struggles of survival.

Kenyans should also demand transparency in the whole process of developing the oil fields if the oil in Ngamia 1 does finally prove to be commercially viable. Some experts point to the fact that the announcement might have been premature, if the oil find doesn’t prove to be commercially viable as has happened before under the Moi administration in the 1990’s.

Instead of being uncertain, Kenyans should be cautiously optimistic, because amongst other things we are the home the greatest long distance athletes on earth. We should be more positive and leverage our learning’s from the mobile money MPESA innovation and look at ways oil can also benefit the lives of normal Kenyans. In the recent past Kenya has also managed to begin turning around its previously dilapidated road network and made a quantum leap in its ICT infrastructure. Examples which should make us believe we can make it with oil.

Either by coincidence or design the LAPPSET infrastructure projects, also launched in early March 2012, that look at developing northern Kenya by building a wide array of infrastructure such as roads, pipelines, railways, airports, resort cities and a deep ocean port in Lamu should accelerate development in Northern Kenya while offering the platform and infrastructure to bring the oil to market.

Like in all oil booms of the past famously chronicled in the award winning book “The Prize” by writer Daniel Yergin. It’s those with strategic vision who actually benefit from oil booms and not necessarily the early birds. Kenyans should look at ways of benefiting from the oil industry by developing knowledge and skills that support the oil industry. This will lead to many millionaires in the years to come and not just a few elite millionaires.

By Eugene Obiero