The Lagos State Government in Nigeria recently hinted on taxing motorcycle hailing start-ups operating in the state in a bid to expand its tax revenue. While this decision may be well-intended, especially from the point of improving the state’s Internally Generated Revenue, one would wonder if enterprise and innovation should be sacrificed for state ends.

Whereas, such policies are not uncommon across the country. But there is a need for stakeholders to realize that encouraging enterprises, especially in their early days, is important in helping the economy.

A Reminder of the Situation

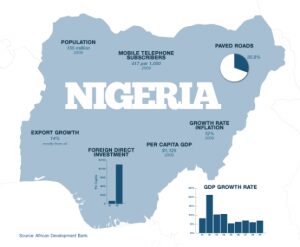

Over the years, Nigeria’s unemployment situation has worsened. More than 36 percent of the country’s youth are without jobs and 23 percent of the entire working-age population were unemployed in 2018.

Although Small and Medium-sized Enterprises (SMEs) are recognized on paper as the engine of economic growth—and by extension, employment, they are yet to successfully help the economy grow despite supports from the government.

In a report by the Nigerian Bureau of Statistics (NBS) and the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN), the number of medium-sized enterprises in Nigeria fell from 4,670 in 2013 to 1,793 in 2017. This represents a whopping 61 percent drop.

More so, the country’s Bank of Industry defines SMEs as bodies with 51 to 200 employees and an annual turnover of ₦500 million or more. Sadly, these businesses which are capable of employing several hundreds of people directly, and much more indirectly, are dwindling in number while the population continues to grow rapidly at 2.6 percent.

The collection of taxes must also be made fairer with the elimination of the multi-layered taxes from local, state, and federal collectors. Property registration should be easy, and access to credit made more reasonable.

Why are most SMEs struggling and many closing down?

Many challenges confront businesses in Nigeria including insecurity, poor infrastructure, lengthy registration processes, and heavy taxes. While some improvements have been achieved in easing business registration and access to loans for SMEs courtesy the Enabling Business Environment Council (PEBEC), much still has to be done to help businesses grow.

For instance, at the Dugbe Market in Ibadan, traders claimed they spend an average of ₦500 each day on gasoline for their power generators. This would not be the case if they had a stable and affordable electricity supply. They also have to deal with high-interest loans at the same time—some as high as 20 percent.

On the corporate end, companies are required to provide a number of allowance, bonuses and insurance contributions to their full-time employees besides normal salaries. But these are detrimental to the unemployed category of the population. This is because the more employee obligations mandated on companies, the less likely they will be to hire more full-time staffs. But this does not mean employee welfare is not important.

Employers face stiff penalties when they fail to perform these statutory obligations. A typical company is however conscious of its wage bill, especially considering the economic realities they face. While employees should be well remunerated, these regulations should be relaxed and made more sense to encourage more medium-sized companies to flourish and be able to employ more people.

Moving Forward

For SMEs to flourish and truly make an impact in Nigeria, there must be significant improvements in the business environment, especially at sub-national levels. To do this, our approach to taxation has to change. The number of taxes a typical SME is required to pay in Nigeria is not encouraging in the light of the huge financial challenges they face.

The collection of taxes must also be made fairer with the elimination of the multi-layered taxes from local, state, and federal collectors. Property registration should be easy, and access to credit made more reasonable. Our economic policies and business environment must show that we are serious about fighting unemployment and not stifling out SMEs.

Stephen Oyedemi is a director at Nigerian based non-profit, Ominira Initiative for Economic Advancement. He works to understand and promote ideas and solutions that help create free and prosperous societies. He tweets @skoyedemi.