The most important price in an economy is the exchange rate between the local currency and the world’s reserve currency — the U.S. dollar. As long as there is an active black‐market (read: free market) for currency and the data are available, changes in the black‐market exchange rate can be reliably transformed into accurate estimates of countrywide inflation rates—if the annual inflation rates exceed 25 percent. The economic principle of Purchasing Power Parity (PPP) allows for this transformation.

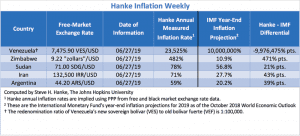

I compute the implied annual inflation rates with high‐frequency data and report them on a daily basis. PPP is used to translate changes in the black‐market exchange rates into annual inflation rates. For the countries that I follow each day, the table below shows the annual rates for the five countries with the highest inflation rates.

Zimbabwe’s inflation is still surging. Zimbabwe’s annual inflation rate as of June 27, 2019, is a whopping 482 percent/yr.

Venezuela has been suffering from hyperinflation since November 2016 and holds down the top spot on my list, with an annual inflation rate of 23,525 percent. Note that my MEASUREMENT of the implied inflation rate is accurate and much lower than the widely reported International Monetary Fund’s (IMF) end‐of‐year FORECAST of an absurd 10,000,000 percent. I write “absurd” because no one has ever been able to forecast the durations and magnitudes of hyperinflations. You can MEASURE hyperinflations with great accuracy, but you can’t FORECAST their durations or magnitudes.

1 comment